[ad_1]

General Mills, Inc. GIS delivered third-quarter fiscal 2022 results, with the top and the bottom line beating the Zacks Consensus Estimate. Earnings increased year over year while net sales remained almost unchanged. Management raised fiscal 2022 guidance, courtesy of year-to-date performance along with projections of solid top-and bottom-line growth in the fiscal fourth quarter.

Management expects at-home food demand to stay above pre-pandemic levels, as people are spending more time working from home. A higher pet population and more humanization and premiumization of pet food amid the pandemic are tailwinds for the company’s pet food category.

GIS is progressing well with the Accelerate strategy, which aims to drive sustainable, profitable growth and robust shareholder returns. General Mills is on track with prioritizing core markets, global platforms and local brands along with reshaping its portfolio via strategic acquisitions and divestitures.

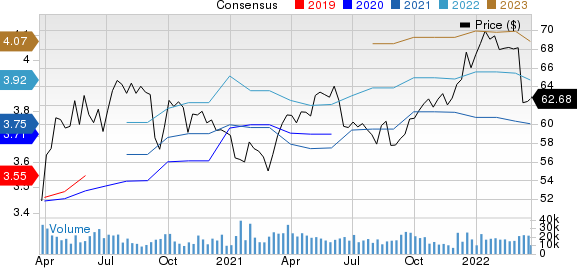

General Mills, Inc. Price and Consensus

General Mills, Inc. price-consensus-chart | General Mills, Inc. Quote

Quarterly Highlights

Adjusted earnings per share (EPS) of 84 cents rose 2% year over year on a constant-currency (cc) basis. The upside can be mainly attributed to lower net interest expenses, increased after-tax earnings from joint ventures as well as reduced net earnings attributable to redeemable and non-controlling interests. These were somewhat offset by reduced adjusted operating profit. The bottom line surpassed the Zacks Consensus Estimate of 77 cents per share. On a two-year compound growth basis, adjusted EPS rose 4% at cc.

Net sales of $4,537.7 million remained essentially unchanged from the year-ago quarter’s figure. The metric included a 3-point net unfavorable impact from divestiture and acquisition activity. Organic net sales rose 4% on the back of favorable organic net price realization and mix to the tune of 7 points. This was somewhat offset by a 4-point negative impact from reduced organic pound volume. The top line surpassed the Zacks Consensus Estimate of $4,508.9 million. Net sales rose 4%, while organic sales increased 5% from third-quarter fiscal 2020 levels.

Adjusted gross margin contracted 160 basis points (bps) to 31.4% due to input cost inflation, supply chain deleverage and escalated other costs of goods sold. These were somewhat offset by positive net price realization and mix as well as cost savings from Holistic Margin Management (HMM).

Adjusted operating profit margin contracted 90 bps to 14.9%.

Segmental Performance

In third-quarter fiscal 2022, General Mills unveiled a new organizational structure. As a result, it will now report results in the following fourth operating segment.

North America Retail: Revenues in the segment came in at $2,811.9 million, up 1% year over year. The uptick can be attributable to positive net price realization and mix, which somewhat offset reduced pound volume. Organic net sales inched up 1% year over year and 6% on a two-year compound growth basis in the segment.

International: Revenues in the segment came in at $721 million, down 23% year over year. Revenues reflect a 20-point adverse impact from divestitures of the European yogurt and dough businesses as well as 2 points of unfavorable foreign currency translation. Organic net sales inched down 1% year over year but rose 4% on a two-year compound growth basis in the segment.

Pet Segment: Revenues came in at $567.7 million, up 30% year over year on the back of solid volume growth and positive net price realization as well as mix. Net sales included 14 points of gains from the pet treats business buyout (concluded on Jul 6, 2021). Organic sales increased 16% year over year.

North America Foodservice: Revenues came in at $437.1 million, up 22% year over year on the back of volume growth and positive net price realization as well as mix. On a two-year compound growth basis, net sales declined 3% in the segment.

Image Source: Zacks Investment Research

Other Financial Aspects

The company ended the quarter with cash and cash equivalents of $844.4 million, long-term debt of $10,944.7 million and total shareholders’ equity of $9,812.9 million. General Mills generated $2,228.1 million as net cash from operating activities during the nine months ended Feb 27, 2022. Capital investments amounted to $351 million. The company paid out dividends worth $934 million and bought roughly 8.8 million shares for $550 million.

Other Developments

Constant-currency sales from the joint ventures of Cereal Partners Worldwide inched up 1% year over year in the quarter. In Haagen-Dazs Japan, sales rose 9% at cc from the prior-year figure.

Fiscal 2022 Outlook

For fiscal 2022, organic net sales are now anticipated to grow roughly 5%, reflecting a projection of sequential improvement in organic net price realization and mix. The company had earlier expected the metric to grow 4%-5%.

Adjusted operating profit at cc is now anticipated between 2% decline to flat year over year, indicating raised organic net sales view. The metric was earlier expected to decline 4%-1%. For fiscal 2022, management continues to expect input cost inflation of 8-9% along with major costs associated with supply chain disruptions.

Adjusted EPS growth at cc is envisioned to be flat to up 2% suggesting improvement from the earlier guidance of down 2% to up 1%. The revised bottom-line view reflects an increased adjusted operating profit outlook.

Shares of this Zacks Rank #3 (Hold) stock has gained 3.5% in the past six months against the industry’s 2.1% decline.

Solid Food Bets

Some better-ranked stocks are Sanderson Farms, Inc. SAFM, Flowers Foods FLO and Pilgrim’s Pride PPC.

Sanderson Farms, the producer of fresh, frozen and minimally-prepared chicken, currently sports a Zacks Rank #1 (Strong Buy). Shares of SAFM have dropped 4.3% in the past six months. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Sanderson Farms’ current financial year sales and earnings per share (EPS) suggests growth of 18% and 56.1%, respectively, from the year-ago reported number. SAFM has a trailing four-quarter earnings surprise of 46.8%, on average.

Flowers Foods, the producer and marketer of packaged bakery products, currently carries a Zacks Rank #2 (Buy). Shares of Flowers Foods have increased 7.7% in the past six months.

The Zacks Consensus Estimate for Flowers Foods’ current financial-year sales and EPS suggests growth of 7.2% and roughly 4%, respectively, from the year-ago reported figure. FLO has a trailing four-quarter earnings surprise of 9%, on average.

Pilgrim’s Pride, which produces, processes, markets and distributes fresh, frozen, and value-added chicken and pork products, carries a Zacks Rank #2. Shares of Pilgrim’s Pride have moved down 17.7% in the past six months.

The Zacks Consensus Estimate for Pilgrim’s Pride’s current financialyear EPS suggests growth of 19.7% from the year-ago reported number. PPC has a trailing four-quarter earnings surprise of 24.9%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Mills, Inc. (GIS) : Free Stock Analysis Report

Flowers Foods, Inc. (FLO) : Free Stock Analysis Report

Pilgrim’s Pride Corporation (PPC) : Free Stock Analysis Report

Sanderson Farms, Inc. (SAFM) : Free Stock Analysis Report

[ad_2]

Source link